20 Puns and 20 Predictions for 2020

I recently joked on Twitter that I am changing my handle from Beer Cruncher to Beverage Cruncher, with 2020 setting up to be the year that those two terms become one in the same. In my last couple years working for Reyes Holdings, I received a crash course in the Coca-Cola business and at the time it felt so different from the beer industry. Just a few years later, I’m not sure where the one ends and the other begins.

I consider myself to be in a unique position having “grown up” through the distribution world at the biggest scale. I currently work at a regional craft brewery that behaves like a big brewery in some ways and a small brewery in others. All while being an active beer geek who visits Taprooms, goes to bottle shares, and posts about beer on Instagram almost daily. I am a fan of the big and the small, and everything in between. So some of my 2020 predictions will look at the industry at a macro level, while others will dig into the small and local moves. Here’s 20 Puns & 20 Predictions for 2020, in no particular order.

1. Craft Beer Lightens Up

When working on the brand Every Day-Hero (4.3% Session IPA) at Rev in 2018, I wanted to call it Light-Hero or Hero-Light. That got shot down pretty quickly because at the time, the group felt as if the word “light” was anti-craft and consumers would assume it was a lager. The rationale made sense and Every Day-Hero was a great name with a ton of potential itself. About a month after it’s release, I scrolled through the Untappd reviews to see what people were saying and I would see reviews like “Light and easy, I like it” or “Solid light IPA”.

While I think the right decision was made, I also think I was onto something, albeit risky. In 2020, I expect to see a big wave of craft brewers putting the word “light” in their brand launches. There’s been sporadic examples getting cute with it, like Night Shift’s Night Lite and the upcoming debut of Bell’s Light Hearted. I believe that a big wave of craft brewers will put light to the test next year, and it will be even more direct that those mentioned and this one below:

2. Hops Stay Up

IPA and all its sub-families have been carrying the growth of craft beer for most of the decade. Whether it was the varying ABVs (Session, Pale, IPA, Double, Triple), the unique hop varieties and combinations, or new methods (Hazy, Brut, Sour), the slate felt endless. I worry that we’re heading toward the leveling off phase of the style, as far as innovation goes, which long term could lead to gradually fading interest. Market forces however are going to prop up IPA and allow it to continue posting high single-digit growth in 2020 (up 14% in the last 52 weeks). As shelf space for beer shrinks in favor of alternatives, the weakest brands will get cut out of store sets. A brewery will 4 shelf spots might be left with only 2 and guess which style will prevail in most situations…IPA. In other words, shelf space will shrink for beer, leaving IPA with a higher percentage of the space than ever. IPA will grow at the expense of other styles. Sad Emoji.

3. Thick N' Crispy - The Unfiltered Lager

There are a few breweries making a ton of beer and a ton of breweries making a little bit of beer. They each play by different rules, have different customers, and have success with different styles. Craft lager has always been challenged with consumers being a lot more comfortable paying $9.99 for a six-pack of pale ale than they are for craft lager. Which is cheaper to make? Raw materials wise, typically it is the lager, but then it all comes down to the value placed on tank time which will vary brewery to brewery depending on the extent they are bumping into capacity constraints.

Despite the struggles that lager has had at a macro level, 2020 is going to feel like they’re back and bigger than ever. As innovation around IPAs stalls, the long tail is looking to lagers as a new way to get their consumers (and themselves) excited. But what the beer enthusiast who frequents small and local breweries loves is a “hook”, or for lack of a better word, a “gimmick”. Has your instagram feed ever blown up with lager more so than the weekend of GABF with shots of Bierstadt’s (Lager-focused brewery in Denver, CO) Slow Pour Pils? I admit, that was my first stop in Denver.

Enter the Unfiltered Pilsner. While I can’t claim to be among the earliest adopters, you definitely would find me sprinting to the Map Room four years ago when they would fly in a keg of unfiltered, unpasteurized Pilsner Urquell. People like “special” and I’m no different, but this version of an internationally respected lager is based off of a beer that’s been mastered. In 2020, we’re going to see a lot of small breweries known for IPAs and stouts jump right to Unfiltered Pilsner, instead of mastering the crisp, clean version first. It will be a little annoying, but their consumers will respond better and if that’s what it takes to get beer traders excited about lager, isn’t it worth it? At least they’re not going to be called Hazy Lagers. Speaking of Haze...

4. The Haze Thickens

Thankfully I don’t mean that literally. Hazy IPAs have reached widespread acceptance in the second half of 2019, thanks in part to Hard Seltzer for the distraction. In 2020, the subset of IPA will carry the load for the hop-forward category’s growth in IRI. I know my readers want that West Coast IPA back in vogue, and while you’ll see plenty in your local taprooms, not so fast from a distribution perspective. The most powerful breweries have focused in on haze including Sierra Nevada, New Belgium, Bells, Firestone Walker, and on down the Top 50 list. And the momentum is still building. Hazy went mainstream and has the support of distributors and retailers. It may feel like it’s already peaked with hardcore enthusiasts, but it’s got a lot of damage left to do in the major leagues. In the upcoming era of SKU rationalization and Keep.It.Simple.Stupid, scaled breweries are focusing in on one well-rounded, drinkable version and getting behind the brand. While I’m sure you’ve had enough Hazy puns, it’s absolutely crucial in my opinion that Hazy be in the name. Make it simple for the casual consumer and avoid the missed sales.

Here’s a few fun stats on the power of hazy:

Hazy Little Thing has passed Torpedo to become Sierra Nevada’s #2 brand.

Mind Haze is already Firestone Walker’s #2 selling individual brand in its first year, though miles behind the untouchable 805.

Bells’ Official is their #3 selling brand behind Two Hearted and Oberon/Seasonal.

5. Seltzer Bubbles Up

I don’t know what officially makes something a fad versus a trend versus a...thing? But I do know that the Seltzer category is not just a one year wonder. White Claw & Truly are going to continue to grow, having earned the full attention and focus of their distributors and retailers. Even if you think they reached peak popularity this past Summer (they didn’t), there’s a whole first half of 2020 (in comparison to 2019) where they’ll see massive growth year-over-year, not to mention addressing their out-of-stocks, the benefit of new line extensions, and continuing to build out marketing plans. White Claw & Truly will maintain their massive market shares, despite the hundreds of new regional and local choices.

6. Bon & Viv Gets Burial At Sea

Anheuser-Busch got off to a slow start in the Hard Seltzer category. Bon & Viv was their initial play and even with all the distribution power behind it, the brand is a dog. In the last 13 weeks, the company's Natural Light Seltzer, which didn't launch until late Summer, has 4X the sales (in $) as of Bon & Viv. I know that there's a price/margin differential between the two, but 1% of market share at this point will not keep them motivated. Natural Light Seltzer is slaying and the soon-to-launch Bud Light Seltzer is going to be an absolute monster. But Bon & Viv's dream of living on land with White Claw & Truly will be short-lived and the brand will join Sebastian at the bottom of the ocean.

7. Sour Breweries Call The Kettle Black

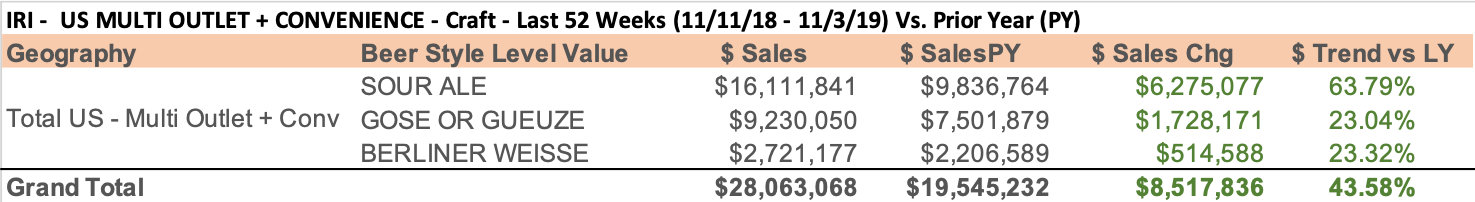

My last blog post about Hard Seltzer was my most misunderstood, and though it performed very well and got lots of good feedback, it definitely did not resonate across the board. The premise was that Seltzer created this large, new category of drinkers who have a high spend tolerance, that is easier to target than any other demographic right now. I believe that enough of this audience would be open to particular styles of beer, with the right tweaks to recipe and messaging, and represent the biggest white space out there for craft breweries looking to “stick to beer”. New formulations of kettle sours (Goses, Berlinners, etc.) will be deployed as “Seltzerternatives” and will serve as a great bet for an uptick in volume.

The more people tend to be "into" beer, the less they typically like kettle sours. After a lot of patience however, look at them making their move now:

Last week I felt vindicated when The Lost Abbey, my favorite brewery in the world, announced their entrance into this better-for-you market by acquiring the naming rights to Tiny Bubbles from Hollister Brewing Company. Founder Tomme Arthur, who gave the State of Craft Beer presentation at last week’s Brewbound Session, declared “The challenge of staying in the craft beer business at this very moment is going to be defined by authentic alternatives.” Though Kettle Sours have historically been the nemesis of breweries focused on barrel-aged sours and wild ales, The Lost Abbey knows that it’s time to put that behind them. Others will follow. In Tomme’s words, Tiny Bubbles will go after “consumers they can’t currently reach” and “target a youthfulness we don’t have, and the hope is we’re going to have fun.”

8. Hard Coffee is a Grind

When I read about Pabst launching their Hard Coffee this past July, I was and still am genuinely intrigued. I am a coffee addict, I love Pabst as a company and brand, and couldn’t think of another product like it. Then MillerCoors (now MolsonCoors) announced their own two months later. Two major players set out to create a category within two months of each other that seemingly didn’t exist prior. And there's likely many more on the way. They had my curiosity, but now they have my attention.

A long time ago I dipped my toe in the start-up world and would always be asked “what problem are you solving?” It was frustrating, but a harsh reality when putting your idea to the test to see if there's really enough of a market. The answers I’ve received on hard coffee, include weekend brunch, tailgates, and pregaming for a night out. Others brought up functional benefits like wanting to loosen up while also staying awake, or even a late night blackjack session at the casino. All of these are certainly fair, but how do you achieve volume at the standards of such big companies, given the infrequency of these occasions and the fact that you’d rarely have two? I’m sure that the margins are leaps and bounds higher per case than the majority of their products, but will the velocity on the shelves keep up? I just can't wrap my head around these.

9. 2pac Forsur

Let me welcome everybody to the Wild Wild West, a state of no bombers that anyone can attest. Tickers don’t need 16oz 4-packs of high gravity or intense barrel-aged beers or pastry stouts, they really just want a can or two so that they can quickly move on to the next thing. In the City of Chicago at least, it’s illegal to sell a single 16oz (or less) single beer to-go. Enter the 2-pack, which has been making its way to specialty shops and Taprooms throughout 2019. The motivation is simply to get it into a can and most of these breweries are set up for 16oz not 12oz. Despite the fact that 16oz is still excessive, expect the amount of these 2-packs you see to multiply exponentially in 2020. Speaking of which:

10. Barrel-aged Sours Can Thrive

I was a proponent on moving barrel-aged stouts and barleywines to cans, having been a part of the decision to do so at Rev. Going with black cans, black ends, and nice cartons helped make up for the premium feel that large format bottles were known for. There were so many reasons for making the change, including how [small format] cans provide more occasions for fans to enjoy them. Though doing barrel-aged sours, aside from small projects at our Brewpub, has never gotten a serious push, I also had a harder time picturing those in cans. Now that barrel-aged stouts have paved the way, I think we’re ready for sours. In 2020 we’ll see some high-end sour producers move to cans in hopes of capturing more of today's enthusiasts. The challenge will be how to give them that premium feel and I look forward to seeing what breweries come up with.

11. The New Tik

Facebook has become an absolute dumpster fire for businesses, with organic engagement in the toilet. Instagram is still red hot, but the platform’s maturity makes it tough to build or expand an audience these days. Twitter is Twitter. Breweries will begin turning to Tik Tok to start fresh with a video-driven, behind the scenes look into their brewery and people with a focus on appealing to younger demographics.

12. Multi-sized Crowlers

Distribution challenges and law changes will lead to breweries doubling down on their taprooms. Additionally, those who’ve lost their newness and face shinier, new competition will look for ways to differentiate themselves and remain a draw. One of the unexpected ways that they’ll offer value and increase the ticket of their customers is through multi-sized crowlers ranging from 8oz to 32oz of those small, brewery-only beers. While an 8oz crowler may seem ridiculous, it allows for a small one-off barrel-aged beer to be sold over the counter without needing to develop artwork and experience losses, low-fills, etc. during packaging. Credit to Austin Beerworks for being the first I saw doing this.

Photo Credit: Austin Beerworks

13. Taproom & Retailer Friction Forces to the Surface

Tension between brewery taprooms and their local retailers has been mostly behind the scenes, but rising to the level of beer podcasts and panel discussions, which has evolved into events and collaborations. Bringing the conversation into public light has not improved the situation and I would argue confidently that it’s worse than ever. The pie, at least here in Chicago, is not growing and breweries are put in difficult situations of allocating their small batch, specialty, and barrel-aged beers. Each business handles it differently and I would argue that some are very short-sighted about it. If you make a special beer and have 60 cases of it, just because you could sell it all out of your taproom, doesn’t mean you’ll be able to in a year from now. Do you invest from the beginning and share the wealth from the beginning, or do you bank the cash and deal with the consequences later? For those banking the cash, will retailers stand up to taprooms and no longer allow them to dictate these terms? Cooler heads have not prevailed thus far and I expect that to continue getting worse in 2020.

14. CBD Causes Anxiety

Put me at the top of the list of those curious about the CBD beverage space. The trends, & data that makes these infused beverages a massive play in 2020 are very real and overlap with each other. To name a few, there's health & wellness, low-calorie, reduced alcohol consumption, along with the rising acceptance and legalization of cannabis-related products. One of my best friends just beat Hodgkin's Lymphoma and credits CBD for getting him through chemotherapy, so a believer I am. For the right people with the right symptoms, I think it’s a valid antidote, however those looking for a recreational affect will be disappointed.

Credit: Untitled Art CBD

Lots of breweries and N.A. beverage companies have already announced or even debuted brands. These could be in the form of non-alcoholic beer, sparkling water, coffee, kombucha, cider, etc. CBD is expensive and causes these otherwise cheap beverages to rise to the price levels of beer, or beyond. Financially, it’s a win for producers, distributors, and retailers with only one problem. It’s still illegal Federally and that makes the big distributors nervous because they have too much to lose. I think this will take a good part of the year to get worked out, if not more, leaving the smaller scrappy distributors and self-distributing breweries as the ones taking the risk and pushing it first. Because of that CBD beverages won’t be making a Hard Seltzer-like boom quite yet, but they’ll be ready to explode once the legalities get worked out.

15. Misuse of “Bubble” Floats On

As an Econ major, a pet peeve of mine is the rampant misuse of the term “bubble”. Bubbles have everything to do with price, and nothing to do with number of competitors. It’s when prices rise to artificial, unsustainable levels, followed by a steep decline. The number of houses in 2008 didn’t crash, their values did. The following could be bubbles within craft beer:

Craft brewery valuations/multiples and the prices that macro breweries were paying

Secondary market prices of Toppling Goliath stouts

$26/four-packs of Triple Dry-Hopped IPAs

Craft breweries are still opening, craft beer is still growing, and handfuls of breweries closing and selling doesn’t make it a bubble. The industry will be challenged heavily by non-alcoholics, CBD, Seltzers, etc. and eventually could run out of room to grow. Breweries will continue to be forced to sell or close and they’ll continue to produce too many SKUs, but the sheer number of them does not constitute a bubble. The misused definition will be used more than ever in 2020 and I will be annoyed! </End rant>.

16. From 0 to 100

One of the untold stories of 2019 is that non-alcoholic beer went from $6M in sales to $26M for a 333% increase over the last 52 weeks. Every single dollar essentially came from Heinken 0.0, which launched to the tune of $17M in that time period. Whether the demand was there, or Heinken created it, they’ve definitely taken control of the category.

The story fits well into everything happening around alcohol consumption, but it’s not as easy as it sounds to pull off. To make a non-alcoholic beer the right way is expensive and may involve vacuuming out the alcohol, meaning it doesn’t cost you any less to produce, but results in the closest flavor comparison. It also takes a significant capital investment, so this can’t be a little side project. Breweries need to bet big if they want to play the game, so I think the list of craft breweries testing the space won’t be too overwhelming, but the category is a huge opportunity for those who can figure out the liquid and market it well. Non-alcoholic beer will grow over 100% off the larger base in 2020 to over $50M in IRI, which is approximately the current size of the Craft Pilsner to give you a comparison.

17. A Package Deal

One of the big collections of breweries operating as a collective unit will sell to a large, likely international player. It could be the result of Private Equity coming calling, market conditions, or it could just be the right time for the owners to exit. Regardless, I predict at least one of these will change hands next year.

18. Small Breweries Reach New Heights

One of my industry infatuations is the 19.2oz can, the huge growth they’re seeing in craft, and the positive impact they can have on a brand. I’ve written extensively about the challenges with this format, especially when the brewery isn’t scaled with deep distribution. Without volume, the format makes very little sense, especially for taprooms where convenience isn’t the priority. You don't get to press a button and your canning line automatically adjusts for the new can height. It can take hours or even all day to make the changes, just to then have to change it right back to your normal size. All that being said, I think it’s going to happen anyway. Stickered/Sleeved 19.2oz cans at taprooms at a premium, like $5/can, and people will freak out and buy them at first ¯\_(ツ)_/¯

Note: I don't consider 3 Floyds to be "small", but wanted to show a stickered 19.2oz can with slick artwork.

19. Craft on Craft Action Gets Steamy

Despite the sales of the last few weeks, including New Belgium and Ballast Point, the biggest “wow” of the year for me was still Dogfish Head merging with Boston Beer. It was a fascinating deal that turned two craft breweries into one and combined synergies about as well as you’ll find from a portfolio perspective. In 2020, the competitive environment is going to bring a number of similar, though smaller, partnerships to light within craft beer. The amount of overhead that can be reduced by operating two brands out of one brewery will be too difficult for many to pass up and financial situations will force breweries into the conversation. Look for a lot of interesting partnerships to be announced in 2020, as breweries find creative solutions to their biggest issues.

20. Declawed

Let's end with a bang. If I put myself 10 years into the future and ask myself what year the White Claw brand would be valued the highest to an outside party, I'd say 2020. Craft Beer was hot in 2013, hotter in 2014, and hottest in 2015 (See Ballast Point sale). I believe that 2015 craft beer = 2020 seltzer. With that in mind, I'm going to make the long shot prediction that it gets sold and that the buyer will not be AB. I have absolutely zero inside information, but if I were in a Vegas casino's sportsbook and there was decent odds, I'd throw $20 down for fun like I always do on the Steelers.

Craft brewers are going through a bit of an identity crisis. Are they breweries or beverage companies? Do they zig or do they zag? How do they focus on the long game when the short term is so uncertain? My simple advice is double down on what you do best and are most passionate about, simplify your portfolio, cut out the noise that's getting in the way, and market the hell out of what you're doing. I hope everyone has a wonderful build-up to the holiday and new year. Keep on hustling, but take care of yourself and get some sleep. The long game requires rest.

Enjoy the article? Help me share it and as always, hit me up on Twitter (@beercruncher) or Instagram (@beeraficionado) with your feedback. Cheers!